Moving To Nashville? What the 2026 Housing Market Looks Like — Insider Forecast

Moving To Nashville? What the 2026 Housing Market Looks Like — Insider Forecast

If you’re Moving To Nashville and wondering what the 2026 housing market will look like, you’ve come to the right place. I’m Susan Thetford from the Living In Nashville Tennessee channel, a native Nashvillian and a Realtor® with more than three decades in this market. In this post I’ll break down exactly what’s happening with prices, inventory, major developments, and the real-world growing pains you should expect — all in plain talk from someone who has watched this city change my whole life.

Why "Moving To Nashville" Still Makes Sense in 2026

People keep asking me whether now is the time for Moving To Nashville. The short answer: yes — but with nuance. Nashville has shifted from a sleepy regional city into a national growth engine. That growth is being fueled by huge employers, large redevelopment projects, and steady in-migration, which keeps demand for housing strong. What’s changing is balance: we’re moving toward a healthier, more balanced market as new supply comes online. If you’re Moving To Nashville, understanding the local details will help you make better choices about where to live, when to buy, and whether to rent first.

2025 Snapshot: What Happened This Year (So Far)

Before we project into 2026, let’s look at 2025. Two national data platforms — Zillow and Redfin — give a useful composite picture:

- Zillow: average home value in Nashville approximately $443,000 (down ~1% year-over-year as of July 31, 2025).

- Redfin: median sales price around $459,000 with median list price near $499,000; another Redfin snapshot puts the median at about $478,000 (up ~1% YoY).

Those numbers put the broad Nashville SMSA squarely in the high-to-mid $400,000s for a median value. But — and this is important — averages and metropolitan snapshots hide the variation between neighborhoods and counties. If you’re Moving To Nashville, you must get granular.

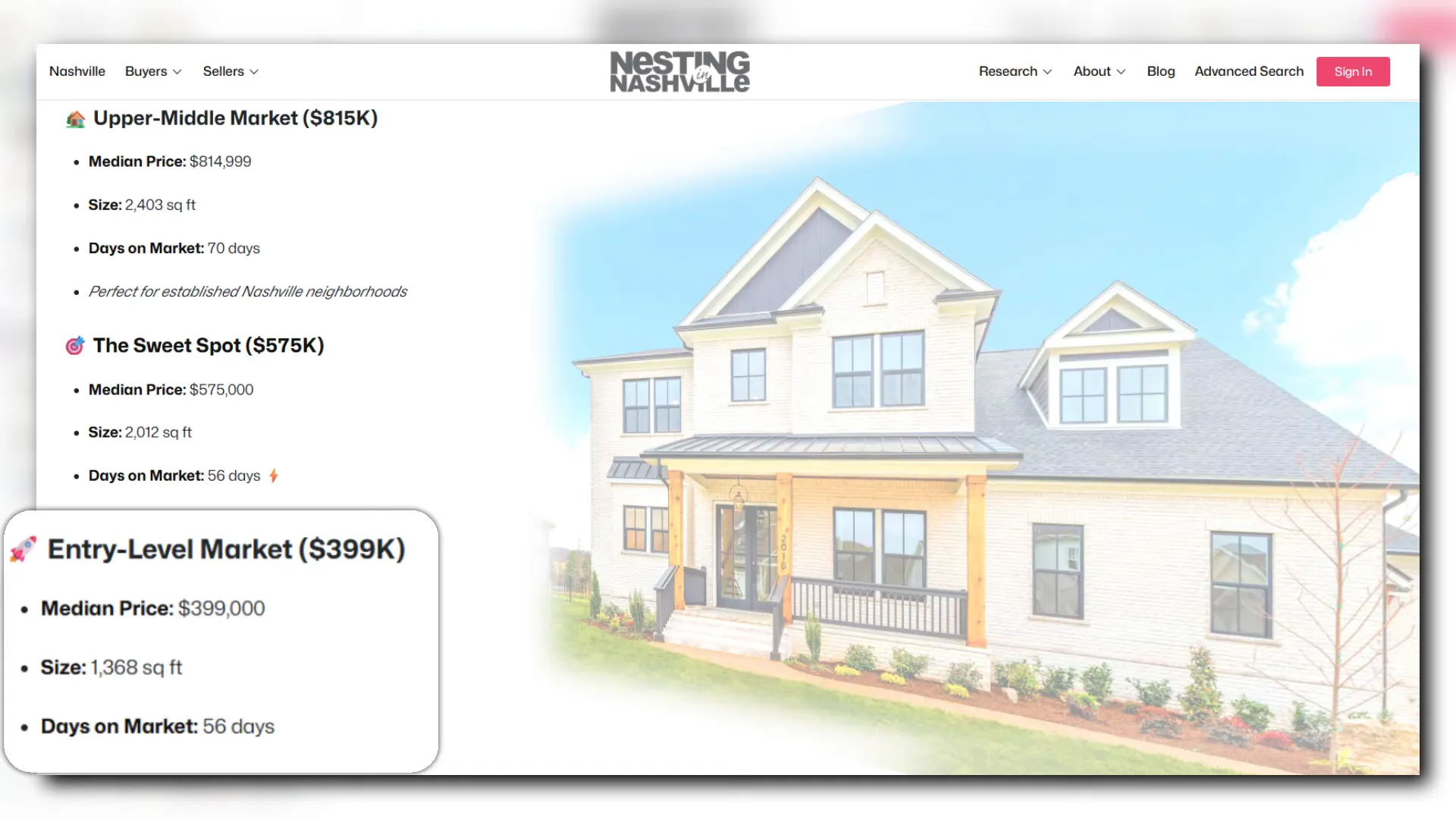

Market Rhythm: Days on Market and Supply

Across the market, entry-level homes cluster around $400,000 and were moving in roughly 56 days — which corresponds to less than a two-month supply. The "sweet spot" mid-range segment (roughly $575k–$800k) also hovered around 56 days. Upper-mid homes ($800k+) slowed a bit to around 70 days. Remember: a six-month supply is generally considered balanced. So while the market has softened compared to the hyper-competitive COVID era, it’s still tilted toward sellers in many pockets.

July MLS Realities: The Local Numbers You Should Know

Here’s what closed in July across the greater Nashville area (MLS data):

- Median days on market for homes that closed in July: 50 days.

- Number of closed sales: ~3,300 (up 3% from July 2024).

- Inventory: up — meaning buyers have more choices than they did a year ago.

- Median sales price: $525,000 (up 5% year-over-year).

- Condo market: median condo prices were down ~2% — a softening that helps first-time buyers.

That mix — higher closed sales, rising median price, and higher inventory — is a classic sign of a market normalizing rather than crashing. If you’re Moving To Nashville, expect more selection but not a wholesale collapse in values.

Why Some People Claim a "Crash" (And Why That’s Misleading)

You’ll hear loud voices on social media predicting a Nashville crash. I’ve watched a few of those narratives float around for the last 18–24 months. Here’s the truth: national YouTube takes tend to generalize. They look for patterns across multiple cities and then declare doom or boom. Nashville hasn’t crashed according to multiple data points (MLS, Redfin, Zillow). Instead, we’ve cooled and normalized.

Some callers and viewers who bought in at peak COVID prices might feel a loss of momentum — but that is not the same as a market crash. Due to strong job growth and continued in-migration, the market has continued to appreciate modestly. Over the last four years, those who listened to "the sky is falling" commentary may have missed 20–30% gains.

Major Employers: What’s Driving Demand

Housing follows jobs. Nashville’s employment base is broad, and that breadth is one reason Moving To Nashville makes sense.

- Vanderbilt University Medical Center — roughly 40,000 employees and 3 million patient visits per year.

- State of Tennessee — ~26,000 employees across agencies.

- Federal government — ~13,500 local workers.

- HCA Healthcare, Ascension St. Thomas, Metro Schools, Vanderbilt University (non-medical), Kroger, Amazon, Bridgestone, Assurion and other large employers.

We also host major corporate operations like Nissan North America and several Fortune 500 companies. That diversity — healthcare, education, logistics, retail, tech, manufacturing — reduces the likelihood of a single-sector crash that could devastate housing demand.

The Game-Changer: East Bank Redevelopment

If you’re Moving To Nashville in the next few years, pay attention to the East Bank redevelopment. This is one of the largest reshaping projects near downtown in recent memory.

- Scale: ~550 acres adjacent to the Cumberland River; core plan focuses on a 338-acre urban design remodel into four mixed-use neighborhoods.

- Timeline: roughly 10–12 years to complete — think phased development across the next decade.

- Features: walkable corridors (Music City Mile, Cumberland Walk), mixed-use residential and commercial spaces, multimodal transit design, resiliency planning.

- Affordable housing: East Bank Flats — a planned six-story, 100% affordable housing project near the future Titans stadium.

Historically, Nashville has lacked many truly walkable urban neighborhoods. That’s changing. The East Bank project alone will add a significant amount of downtown housing, restaurants, and commercial space — the kind of product many relocating buyers want.

The Scrapyard Sale: $245 Million — Big Signal

Hot off the press: a recent $245 million purchase of the old riverfront scrapyard signals private investor confidence in downtown redevelopment. That parcel overlooks the new Titan stadium site and will require remediation and shovel-ready prep, but its sale is a major vote of confidence. When big parcels move, developers and builders follow — and housing supply on the urban core will increase.

Oracle River North: A Corporate Headquarters Boom

Another transformative project is Oracle’s River North plan. Oracle is planning to relocate a world headquarters to the area, with rezoning already underway. The scope has expanded and the project is expected to create approximately 8,500 jobs over a decade. That kind of demand is material: headquarters bring highly-paid employees, vendor demand, restaurants, and new housing requirements.

National Accolades and Why They Matter

Nashville’s popularity isn’t by accident. We’ve been named among the most beloved major cities in net favorability and ranked as one of the top places to move in multiple national lists. In 2025 we tied with Tampa as one of the top destinations. For investors, Nashville was in the top five housing markets to watch in 2025.

Accolades create momentum. They attract remote workers, corporations, and tourists. Tourism feeds hospitality, which feeds service jobs — and service jobs create baseline housing demand for entry-level buyers and renters. If you’re Moving To Nashville for job opportunities or lifestyle, those rankings help explain why both populations and housing demand remain strong.

Growing Pains: The Real Issues Residents Talk About

Growth is great, but not without trade-offs. If you’re Moving To Nashville, prepare for these realities:

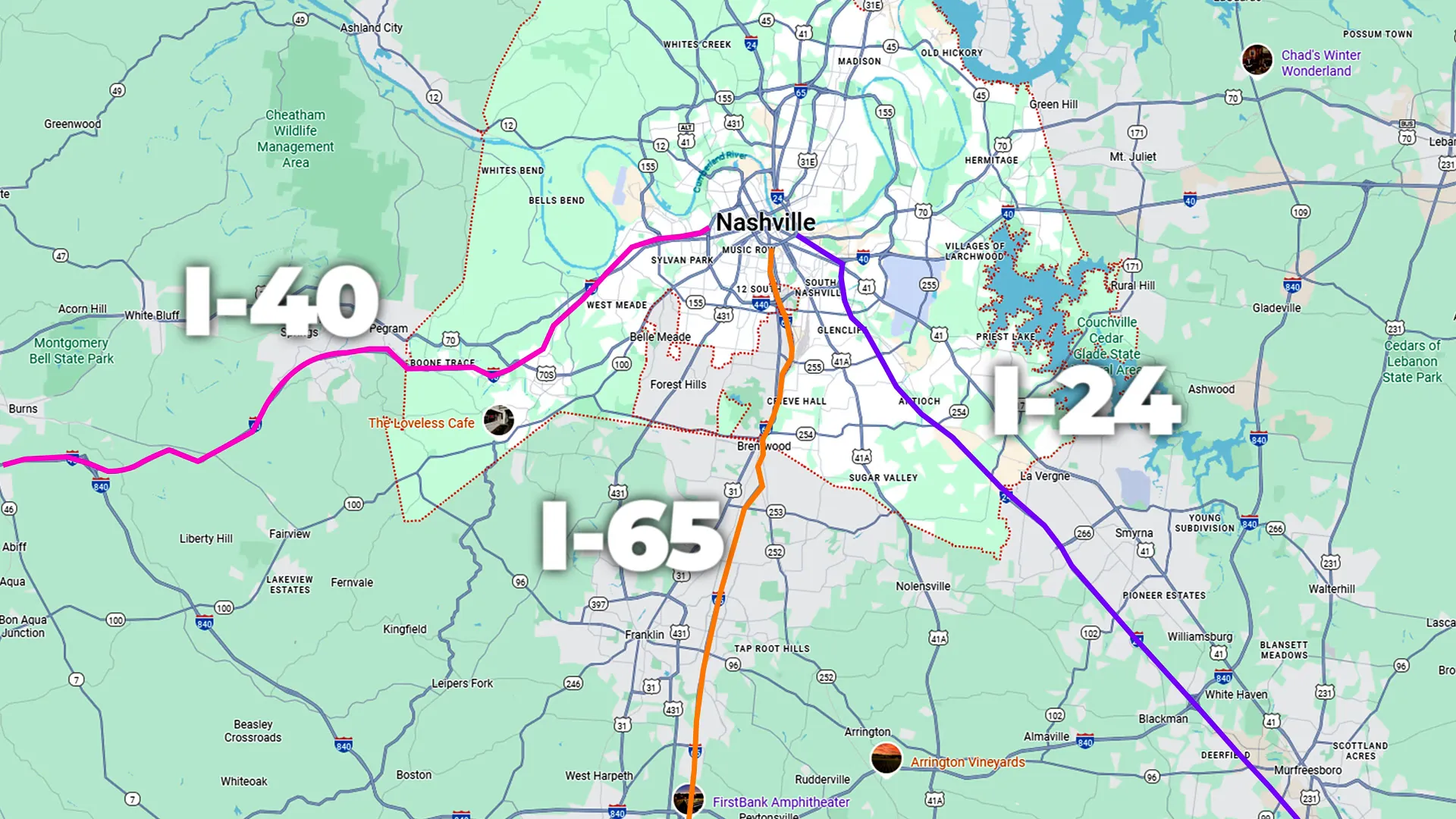

1. Traffic

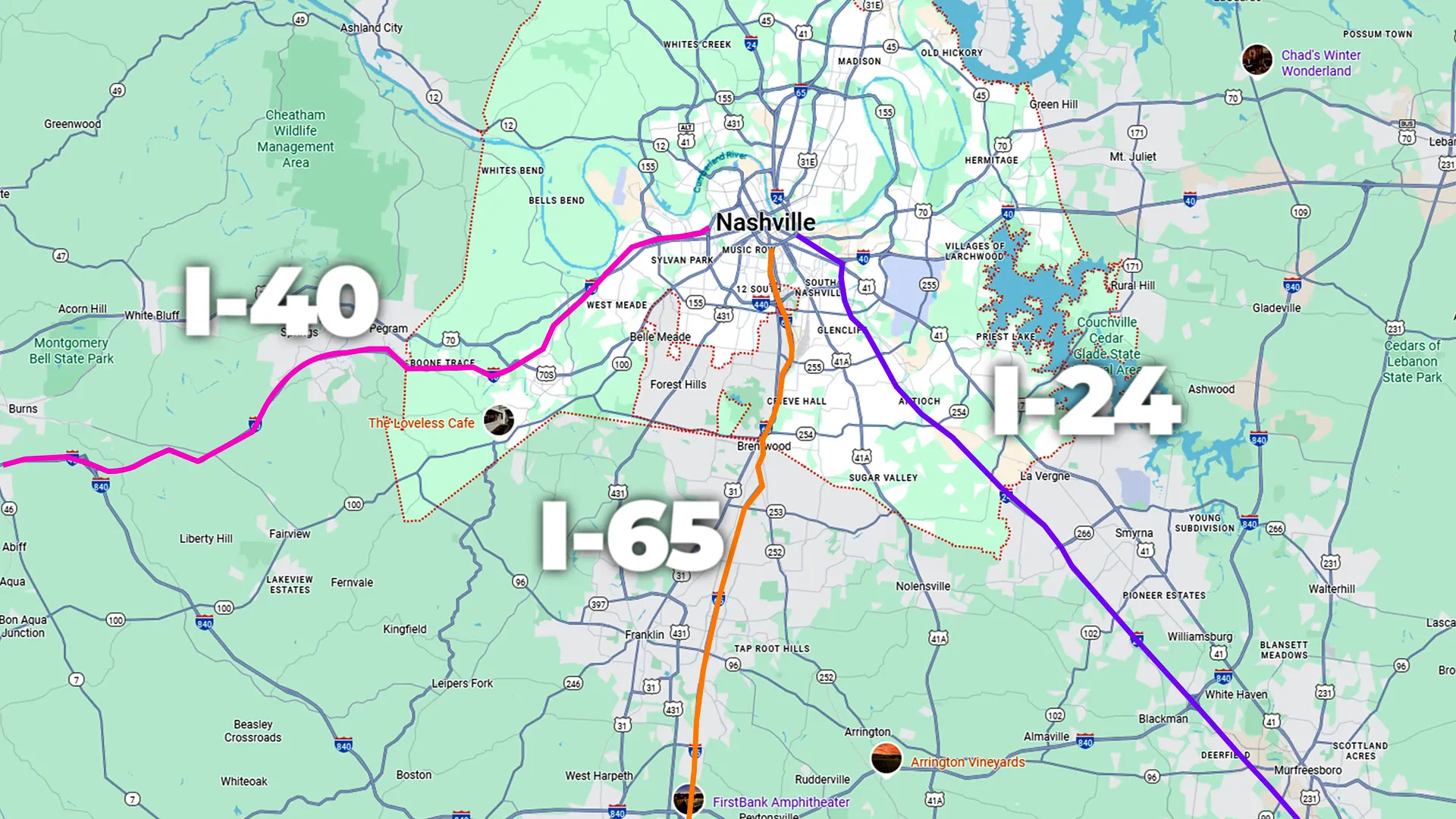

Traffic is the number one complaint I hear. With three major interstates (I-65, I-24, I-40) converging on Nashville, congestion happens. The I-840 loop helps divert some trips, but if you’re commuting downtown during rush hours, plan for delays. For now, Nashville is a car-oriented city. The East Bank and other walkable projects will help reduce some trips in the long-term, but that’s years away for meaningful impact.

2. Schools and Education Pressure

Rapid population growth puts pressure on schools. We are building schools quickly, but some public systems have lagged behind demand. Many families choose Williamson or other counties for favorable public school ratings, and private school options exist but at added cost. If you’re Moving To Nashville with children, check greatschools.org and niche.com as a starting point, and plan accordingly.

3. Infrastructure and Funding Priorities

When budgets are tight, big cultural projects sometimes wait. For example, additions to performing arts infrastructure have been delayed until funding is available. That conservative approach isn’t a negative — it’s fiscally responsible — but it does mean the city must choose what to prioritize: roads and transit, or cultural expansion. Expect both to be discussed and phased over time.

4. Neighborhood Change and Teardowns

Closer-in neighborhoods that were once characterized by older homes and larger lots (think Green Hills, Forest Hills) are seeing teardowns and higher-end infill. Longtime residents notice rapid change in neighborhood character; newcomers see new construction with premium pricing. If you’re Moving To Nashville and you value a stable, slow-changing community, downtown Nashville may not match that desire. But for many buyers, the trade-off is worth it: proximity, amenities, and a walkable urban lifestyle.

Where to Look: County-by-County Notes for Buyers

When people ask where to buy as they are Moving To Nashville, the simple answer is: it depends. Here’s a quick county-by-county guide to help you think through choices:

Davidson County

Davidson includes downtown, Germantown, East Nashville, Green Hills, Oak Hill, and surrounding neighborhoods. Prices here skew higher in desirable neighborhoods with shorter commutes to downtown jobs. Walkable, historic neighborhoods are limited but expanding with projects like East Bank.

Williamson County

Williamson (Franklin, Brentwood, Thompson’s Station) is one of the most expensive counties with strong schools, premium single-family homes, and family-oriented suburbs. Zip codes vary widely — east and west sides often cost less than north and central portions.

Wilson, Sumner, Maury (Murray) Counties

These outer counties are where many builders are focusing new construction. Expect more volume, newer neighborhoods, and often better value for the square footage. If you’re Moving To Nashville on a budget or want acreage, these areas deserve a hard look. Cities like Gallatin and Columbia can be excellent value plays.

What Moving To Nashville Means for Buyers, Sellers, and Investors in 2026

Buyers

More inventory in 2026 means better choices — especially entry-level condos and urban townhomes like the East Bank Flats. The condo market has flattened, which helps first-time buyers. Expect purchasing timelines to be a bit longer than at the height of the seller’s market; people are more deliberate. If you’re Moving To Nashville, get pre-approved, decide your "must-have" neighborhoods, and be ready to move decisively when the right property appears.

Sellers

Sellers still hold the advantage in many neighborhoods — particularly well-priced, well-presented homes near hotspots (Belme, Germantown, West Meade, Hillwood, many Williamson County locations, and Mount Juliet). But offers aren’t flying off the table instantly like in 2020–2021. Expect 2–3 months on the market and understand that presentation, pricing, and marketing strategy matter more than ever.

Investors

Investor opportunities are becoming tighter for traditional "buy and flip" playbooks. It’s harder to find deeply discounted bargains at 20–25% below market. That said, rental demand remains strong thanks to job growth and population inflows. Key investor opportunities will likely concentrate around East Bank, Oracle’s campus, and healthcare-related quarters that will appreciate earlier and faster.

Interest Rates: The Wild Card for People Moving To Nashville

I’m candid with clients: I don’t want a dramatic drop in interest rates. Why? A steep rate decline could trigger a bidding frenzy similar to the COVID market, pushing prices up fast and eroding buyer affordability. A slow, moderate move in rates is preferable — it helps buyers without reintroducing hyper-competition.

If mortgage rates fall substantially (for example, dropping 0.75% or more), expect a surge in buyer activity. If rates remain steady, we’ll likely see continued balance — more inventory and modest appreciation, not runaway growth.

Practical Next Steps if You’re Moving To Nashville

If you’re seriously considering Moving To Nashville, here are practical steps to take:

- Define your priorities: commute tolerance, school preferences, desired lifestyle (urban walkable vs. suburban), and budget.

- Get pre-approved for a mortgage — not just pre-qualified. This gives you leverage in negotiations.

- Work with a local agent who understands micro-markets. Nashville’s market varies dramatically by zip code and neighborhood.

- Visit neighborhoods in person if possible. Photos and numbers tell part of the story, but walkability, noise, and community vibe matter.

- Consider renting first if you need flexibility, especially if you’re moving from out of state and want to "try" neighborhoods before buying.

Relocation Resources

To help people Moving To Nashville, I’ve put together a relocation guide with about 50 pages of practical information — neighborhoods, schools, popular suburbs, parks, events, and local hotspots. It’s designed to give you an informed starting point so you don’t feel overwhelmed.

If you want a one-on-one conversation, schedule a 30-minute call to talk through your needs and get a tailored plan for your move. The right plan will consider your timeline, budget, and lifestyle goals.

My 2026 Forecast — Short and Honest

All systems are go. I expect Nashville to continue its steady growth into 2026. Here are my specific predictions:

- Overall appreciation: modest and steady — not double-digit dramatic gains, but continued positive appreciation in most areas.

- Inventory: gradual increase, particularly in the urban core and outer suburbs as big development projects and national builders deliver product.

- Days on market: likely 2–3 months in many neighborhoods, with quicker movement in highly desirable, well-priced pockets.

- Rentals: strong demand, especially near major job centers and new corporate campuses.

- Investor opportunities: best near East Bank, Oracle campus, and healthcare corridors; harder to find deep value elsewhere.

My biggest fear: a sudden drop in interest rates that reignites frenzied bidding. That would reintroduce affordability crunches and intense competition. For the long-term health of the market and people relocating here, I prefer a stable, measured environment.

Final Thoughts for Anyone Moving To Nashville

Moving To Nashville remains a compelling option. This city offers strong job growth, national recognition, and a diversified economy that reduces volatility risk. But growth comes with traffic, school pressures, and infrastructure needs. If you value walkability, the East Bank and downtown projects are increasingly attractive. If you want space and value, the outer counties will continue to deliver new construction and relatively better pricing.

Whether you’re Buying, Selling, Investing, or simply Relocating: get the facts, get local guidance, and move with a plan. I’ve helped hundreds of families over the years make this transition — and I’m happy to help you, too.

— Susan Thetford, Living In Nashville Tennessee

Susan Thetford

As a Nashville native, real estate agent, and retired general contractor, I bring a unique perspective to home buying and selling. My background allows me to help clients understand a home’s true potential, costs, and value—beyond what meets the eye.

With my mother-daughter real estate team, we provide a seamless, client-first experience with personalized service and expert guidance.

LATEST VIDEO